Keeping Track of Expenses

Employee expenses are charges incurred on behalf of the company. The company then reimburses these expenses to the employee. The receipts encountered most frequently are:

- car travel, reimbursed per unit of distance (mile or kilometer),

- subsistence expenses, reimbursed based on the bill,

- other purchases, such as stationery and books, destined for the company but carried out by the employee.

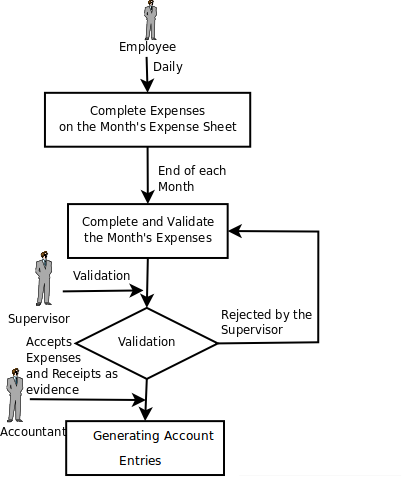

Process for Dealing with Expense Reimbursements

Expenses generated by employees are grouped into periods of a week or a month. At the end of the period, the employee confirms all of his expenses and a summary sheet is sent to the department manager. The manager is responsible for approving all the expense requests generated by his team. The expense sheet must be signed by the employee, who also attaches its receipts to the expense sheet.

Once the sheet has been approved by the head of department, it is sent to the Accounting department, which registers the company's liability to the employee. Accounting can then pay this invoice and reimburse the employee who originally advanced the money.

Some receipts are for project expenses, so these can then be attached to an analytic account. The costs incurred are then added to the supplementary cost of the analytic account when the invoice is approved.

You often need to invoice expenses to a customer, depending on the precise contract that has been negotiated. Travelling and subsistence expenses are generally handled this way. These can be charged to the customer at the end of the month if the contract price has been negotiated inclusive of expenses.

If you have to go through many steps to reclaim expenses, it can all quickly become too cumbersome, especially for those employees who claim large numbers of different expense lines. If you have got a good system that integrates the management of these claims, such as the one described, you can avoid many problems and increase staff productivity.

If your systems handle expenses well, then you can avoid significant losses by setting your terms of sales effectively. In fixed-price contracts, expense reimbursements are usually invoiced according to the actual expense. It is in your interest to systematize their treatment, and automate the process to the maximum, to recharge as much as you are contractually able.

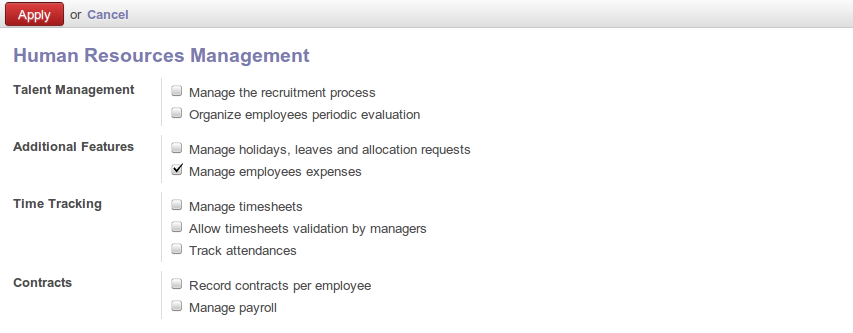

Allow employees to enter professional expenses

Install the module hr_expense to automate the management of expense claims. Go to the menu Settings > Configuration > Human Resources. And then click on the Apply button.

Install hr_expense module

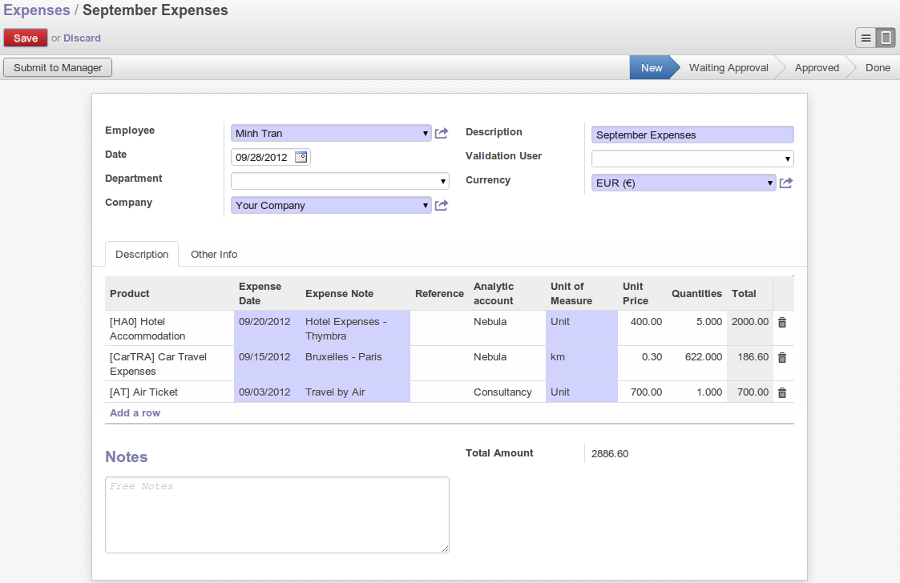

Users can then enter and review their expenses using the menu Human Resources > Expenses > Expenses.

Expenses form to enter and review expenses

Create templates for the various expenses accepted by the company using Odoo ERPOnline's product form. You could, for instance, create a product with the following parameters for the reimbursement of travel expenses by car at 0.25 per kilometer:

Name: Car travel ,Default Unit Of Measure: km ,Cost Price: 0.25 ,Sale Price: 0.30 ,Product Type: Service .

The employee keeps his expenses sheet in the Draft state while completing it throughout the period. At the end of the period (week or month), the employee can confirm his expense form using the Submit to Manager button on the form. This puts it into the state Waiting Approval .

Track the approval management process

At the end of the period, the department manager can access the list of expense forms awaiting approval using the menu Human Resources > Expenses > Expenses.

The department manager can then approve or refuse the expenses. Now, the Generate accounting entries button is visible which on clicking creates a purchase receipt, in the employee's name so that the employee can be reimbursed. An analytic account is coded onto each line of the receipt. The purchase receipt (on creation) automatically goes into the posted state, generating analytic accounting entries as they would be with any other invoice.

Rebill customers through analytical accounts

If you base your invoicing on service time or analytic costs, the expense will automatically be charged to the customer when the customer invoice is generated for services associated with the project.

Invoicing from timesheets allows you to prepare all your invoices, both expenses and timesheets for a project's customer.

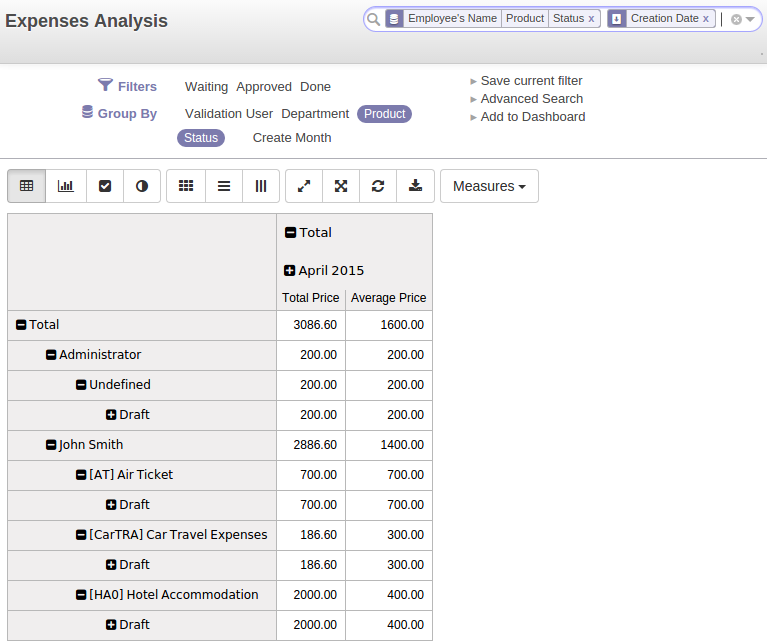

You can view the statistical analysis of expenses using menu Reporting > Human Resources > Expenses Analysis.

Expenses Analysis